Report on Business

You are here

Report on Business: Flowers bloom amid the turds of COVID

February 28, 2021

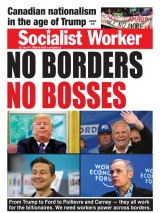

It is an ill wind that doesn’t blow somebody some good. During the first 6 months of the COVID emergency, while millions of Canadians were losing their jobs, worrying about getting evicted, and dealing with the trauma of isolation, the nation’s top 20 billionaires added about $2 Billion each to their piles.

Their windfall was not unique. In the US, billionaires collectively added $931 Billion to their collective hoards.

According to a policy paper from the Canadian Centre for Policy Alternatives, published in September: “At the same time as billionaires like Loblaws owner Galen Weston have seen their wealth balloon, front-line workers stocking shelves and scanning groceries at his stores have continued to risk their health and that of their loved ones by coming into work. To add insult to injury, front-line grocery store workers have had their $2 per hour ‘pandemic pay’ clawed back while the grocery store owners made huge profits.”

Our beloved 5 big Canadian banks are also making out like bandits, only they aren’t bandits, really they aren’t. Just because they charge you about $150 per year in bank fees just to get access to your own money doesn’t make them bandits.

The right Royal Bank of Canada, for instance just posted its “earnings” for the first quarter of 2021. Because they are so modest, they don’t refer to “billions”. They refer to thousands of millions. According to the RBC press release: “Royal Bank of Canada (RY on TSX and NYSE) today reported net income of $3,847 million for the quarter ended January 31, 2021, up $338 million or 10% from the prior year.”

Keep in mind that the “prior year” was a record setting year. Did you get a 10% raise over last year?

And RBC is not exceptional. The other big banks report similar increases over last year’s income. These are happy days for equity markets and speculation. There, doesn’t that make you feel better?

Section:

Topics: